2022/2023 (Spring) Election Update

In May 2023, Richland Township (Bucks County) voters approved an Earned Income Tax ballot referendum to continue a 0.1% allocation for Open Space funding measures. In the ballot referendum, 89% of voters (1,441 in favor to 186 opposed) approved the measure, reflecting a statewide data trend of voters supporting conservation ballot measures.

In 2022, six communities within the DVRPC region - two in Pennsylvania and four in New Jersey - voted on referendums to create or amend dedicated funding mechanisms to protect open space. Three of these measures passed and three were rejected. In addition, one community in Pennsylvania, West Sadsbury Township, voted to discontinue their open space tax. All seven of these referendums were voted on in the November 8 general election.

In Chester County, residents in Westtown Township voted to approve a ballot referendum to increase the local earned income tax rate from 1.0% to 1.08% and the real estate tax rate from 3.5 mills to 3.92 mills (1 mill is equal to $1 in property tax levied per $1,000 of a property’s assessed value.) This will generate $7.5 million in revenue which will enable the township to pay for 25% of the cost of preserving Crebilly Farms. The other 75% will come from grants. In West Sadsbury Township, voters approved a referendum to discontinue the Township’s 0.70% open space earned income tax. This tax was created to purchase the Jim Woodland Preserve for preservation and the township now has enough money from the tax to pay off the debt from the purchase.

In Montgomery County, 55% of voters in Limerick Township rejected a 0.25% earned income tax increase which would have been used to finance the acquisition of open space, forest and agricultural conservation easements, property development rights, and acquiring recreation or historic lands. This proposed tax would have lasted for 10 years and helped preserve 33 properties covering more than 1,000 acres which planners had already prioritized as desirable.

In Burlington County, Bordentown Township, Edgewater Park Township, and Lumberton Township all voted on whether to establish or increase a tax for open space funding. The referendums passed in Bordentown Township and Lumberton Township and did not pass in Edgewater Park.

In Bordentown Township, voters authorized the establishment of an Open Space and Recreation Trust Fund through an annual levy of .02 per $100 of assessed real property value. This fund would expire after 20 years and can be used for the acquisition, development, and maintenance of land for recreation and conservation purposes as well as historic preservation. Lumberton Township voters approved a 2-cent increase to the existing open space tax of 1-cent per $100 of assessed valuation. The measure is expected to raise $5.5 million over the next 20 years. The referendum in Edgewater Park, which was also for a 2-cent increase to the existing 1-cent open space tax, was narrowly defeated.

In Mercer County, voters in Robbinsville Township rejected a proposed 2-cent increase to an existing tax to pay for open space, recreation and farmland. But the existing open space tax remains in effect.

Referendums 1988-May 2023

Referendums proposing additional taxes, bond levies, or other dedications are a political measure of public support for public expenditures on open space.

- Between 1988 and May 2023, voters in the DVRPC region approved 248 referendums authorizing counties and municipalities to levy additional taxes or issue bonds dedicated to open space preservation.

- All eight of the region’s suburban counties and 130 of the region's 352 municipalities (37 percent) have submitted open space funding referendums to voters.

- Referendums have passed in eight of the eight suburban counties and 123 of the 130 municipalities where they have been issued. Currently, 112 municipalities have active programs. Programs expire when previously issued bonds are exhausted and/or open space taxes are discontinued.

Over the last 35 years, voters in the DVRPC region (excluding state-wide initiatives) have approved over $780 million in bonds and have approved tax measures that generate hundreds of millions of dollars annually for open space preservation.

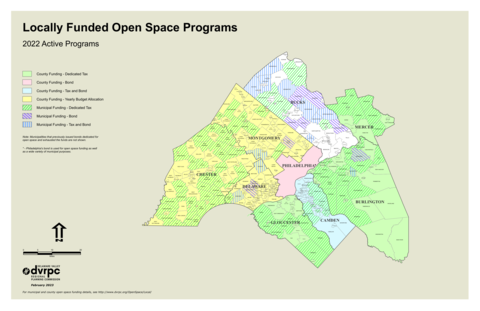

Active Locally Funded Open Space Programs (as of May 2023)

Since the late 1980s, efforts to buy up remaining open space as a means of protecting natural resources, providing for recreation and shaping local development have escalated among the counties and municipalities in the region.

DVRPC began tracking locally funded open space programs after the April 1999 elections. The inventory of active locally funded open space programs, which follows below, is updated regularly.

Every year, multiple municipalities and counties may pass binding and non-binding referendums to establish open space trust funds (which are funded via a dedicated tax) or issue a bond dedicated to open space preservation. Referendum initiatives represent direct democracy as voters demonstrate their willingness to pay for open space preservation. Municipal and county elected governing bodies can also raise taxes, allocate funding from the annual budget, and issue bonds without voter referendums.

In an effort to capture up-to-date funding, Active Funding Programs is an inventory of local governments that may have remaining bond funds, levy taxes, or dedicate a yearly budget allocation for open space preservation. Local governments were considered to have an active program if they received allocations in 2022, collected or plan to collect a tax in 2023, or issued a bond and the bond funds have not yet been exhausted.

- In the DVRPC Region, all nine counties have funds available for open space preservation and acquisition. Two of those counties allocate general funds from the capital budget, which changes from year to year.

- All four New Jersey counties have a dedicated tax for open space, and one (Camden) has an active bond in addition to the tax.

- In the DVRPC Region, 90 of 352 municipalities have a dedicated tax for open space only, 7 municipalities have an active open space bond only, and thirteen municipalities have both a tax and a bond.

New Jersey Active Funding Programs

Burlington County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Burlington County | $0.02 | $9,869,092 | 1996=.02; 1998=.04; 2006=.04; 2020=.02 | |

| Bordentown Township | $0.02 | 1999=.03; 2022=.02; | ||

| Cinnaminson Township | $0.02 | $337,000 | 2004 | |

| Delanco Township | $0.02 | $101,000 | 2004 | |

| Delran Township | $400,000 | 2021 | ||

| Eastampton Township | $9,300,000 | 2004 | ||

| $0.02 | $225,000 | 1998=.03; 2001=.02; 2019 = 0.02 | ||

| Edgewater Park Township | $0.01 | $31,000 | 2000 | |

| Evesham Township | $0.06 | $3,240,000 | 1998=.01; 2000=.03; 2021=.06 | |

| Florence Township | $0.01 | $121,000 | 2008 | |

| Hainesport Township | $0.03 | $132,000 | 2001=.01; 2004=.03 | |

| Lumberton Township | $0.03 | 2000=.01; 2003=.03; 2005=.01; 2022=.03; | ||

| Mansfield Township | 0.038% | |||

| Medford Township | $0.01-0.03 | $534,000 | 1998=.02; 2000=.03; 2013=.01-.03 | |

| Moorestown Township | $0.06 | $468,000 | 1998=.02; 2001=.06; 2007=.06 | |

| Mount Laurel Township | $0.08 | $4,638,000 | 1998=.02; 2001=.04; 2002=.08; 2007=.08; 2017=.08 | |

| North Hanover Township | $0.07 | $212,000 | 1999=.02; 2003=.04; 2004=.11; 2009=0.07 | |

| Shamong Township | $0.02 | $82,000 | 2004 | |

| Southampton Township | $0.02 | $153,000 | 2001 | |

| Springfield | $0.02 | $90,000 | 2001 | |

| Westampton Township | $0.02 | $231,068 | 1999=.02; 2005=.02; 2017=.02 | |

| Totals | $9,300,000 | $21,458,160 |

Camden County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Camden County | $28,000,000 | 2003 | ||

| $0.02 | $6,000,000 | 1998=.01; 2005=.02 | ||

| Berlin Borough | $0.02 | $82,000 | 2008 | |

| Berlin Township | $0.04 | $138,000 | 1999 | |

| Cherry Hill Township | $0.01 | $457,200 | 2000 | |

| Clementon Borough | $0.03 | $35,000 | 2000 | |

| Gibbsboro Borough | $0.02 | $57,000 | 2001 | |

| Gloucester Township | $0.02 | $907,000 | 2001 | |

| Haddonfield Borough | $0.005 | $113,000 | 2006=.02; 2011=.01; 2016=.01; 2017=0.005 | |

| Stratford Township | $0.02 | $29,000 | 2008=.01; 2013=.02 | |

| Voorhees Township | $0.04 | $770,000 | 2003 | |

| Totals | $28,000,000 | $8,588,200 |

Gloucester County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Gloucester County | $0.04 | $10,400,000 | 1993=.01; 2000=.02; 2004=.04 | |

| East Greenwich Township | $280,000 | 2010 | ||

| $0.03 | $180,000 | 1998=.01; 2003=.03 | ||

| Franklin Township | $0.01 | $81,000 | 1999 | |

| Harrison Township | $0.03 | $794,000 | 1999=.01; 2002=.01; 2004=.05; 2005=.04 | |

| Logan Township | $0.01 | $62,000 | 1999 | |

| Mantua Township | $0.02 | $156,000 | 2000=.01; 2004=.03 | |

| Monroe Township | $0.02 | $145,000 | 2003 | |

| South Harrison Township | $0.01 | $40,000 | 1998 | |

| Washington Township | $0.02 | $515,000 | 2000 | |

| Woolwich Township | $0.03 | $312,000 | 1998=.01; 2002=.02; 2004=.03 | |

| Totals | $280,000 | $12,685,000 |

Mercer County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Mercer County | $0.03 | $9,310,000 | 1989=.01; 1998=.02; 2004=.03 | |

| Hopewell Borough | $0.01 | $36,000 | 2000 | |

| Hopewell Township | $0.05 | $1,345,000 | 1998=.02; 2002=.03; 2004=.04; 2008=.05 | |

| Lawrence Township | $0.03 | $806,000 | 1999=.01; 2001=.03 | |

| Pennington Borough | $0.01 | $50,000 | 1998 | |

| Princeton (Consolidated) | $0.017 | $1,161,000 | Township: 1997=.01; 2000=.02. Borough: 2000=.01. Consolidated: 2012=.017 | |

| Robbinsville (Washington) Township | $0.065 | $385,801 | 1998=.01; 2000=.05; 2016=.065 | |

| West Windsor Township | $0.03 | $1,826,000 | 1993=.01; 1995=.02; 1998=.07; 2005=.05 | |

| Totals | $0 | $14,919,801 |

Pennsylvania Active Funding Programs

Bucks County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Bucks County | ||||

| Bedminster Township | $2,500,000 | 2005 | ||

| 0.25% | $280,000 | 2005 | ||

| Buckingham Township | $0.0050 | $190,000 | No referendum | |

| $20,000,000 | 2008 | |||

| East Rockhill Township | 0.250% | $240,000 | 1999=.125%; 2006=.250% | |

| Hilltown Township | 0.250% | $600,000 | 2000 | |

| Lower Makefield Township | $15,000,000 | 2008 | ||

| Milford Township | 0.250% | $58,000 | 1997=.02; 2007=.250% | |

| $5,000,000 | 2007 | |||

| New Britain Township | 0.125% | $382,000 | 2000 | |

| Newtown Township | 0.100% | $680,000 | 2008 | |

| Nockamixon Township | 0.250% | $190,000 | 2004 | |

| Plumstead Township | $4,500,000 | 2009 | ||

| Richland Township | 0.100% | $320,000 | 2002=.10; 2016=.10; 2023= .10 | |

| $4,000,000 | 2002 | |||

| Solebury Township | $12,000,000 | 2019 | ||

| Springfield Township | 0.250% | $232,000 | 2000 | |

| $5,000,000 | ||||

| Tinicum Township | 0.250% | $250,000 | 2002 | |

| $0.005 | $35,000 | 2002 | ||

| Upper Makefield Township | $10,000,000 | 2005 | ||

| $0.1075 | $2,440,000 | No referendum | ||

| Upper Southampton Township | $2,000,000 | 2002 | ||

| $0.0075 | $144,000 | No referendum | ||

| Warrington Township | $3,000,000 | 2012 | ||

| Warwick | $7,000,000 | 2006 | ||

| West Rockhill Township | 0.250% | $250,000 | 2000=.125%; 2004=.25% | |

| Wrightstown Township | 0.250% | $142,000 | 2002 | |

| $1,500,000 | 2006 | |||

| Totals | $91,500,000 | $6,433,000 |

Chester County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Chester County | Yearly budget allocation: No referendum | |||

| Charlestown Township | 1.00% | $120,000 | 2003=.50%; 2008=1% | |

| East Bradford Township | 0.250% | $460,000 | 1998=.0125%; 2000=.25% | |

| East Brandywine Township | 0.125% | $175,000 | 2002 | |

| East Coventry | 0.250% | $382,500 | 2010 | |

| East Marlborough Township | $0.02 | $95,000 | 1999 | |

| East Nantmeal Township | 0.250% | $100,000 | 2003 | |

| East Nottingham Township | 0.250% | $700,000 | 2004=.50%; 2015=.25% | |

| East Pikeland Township | 0.25% | $250,000 | 2006 | |

| East Vincent Township | 0.325% | $200,000 | 2002=.125%; 2006=.325% | |

| Elk Township | 0.50% | $125,000 | 2006 | |

| Franklin Township | $0.05 | $120,000 | 2002 | |

| Highland Township | 0.50% | $100,000 | 2004 | |

| Honey Brook Township | 0.50% | $500,000 | 2005 | |

| Kennett Township | 0.25% | $263,000 | 2005 | |

| $0.02 | $177,000 | 2005 | ||

| London Britain Township | $0.02 | $36,000 | 2000 | |

| London Grove Township | 0.25% | $275,000 | 2006 | |

| Londonderry Township | 0.25% | $67,000 | 2003 | |

| Lower Oxford Township | 0.50% | $300,000 | 2003 | |

| New Garden Township | 0.125% | $308,000 | 2005 | |

| Newlin Township | $0.015 | $19,000 | 2016 | |

| North Coventry Township | 0.25% | $400,000 | 2002 | |

| Pennsbury Township | 0.079% | $250,000 | 2009 | |

| Pocopson Township | $0.01 | $275,000 | 2006 | |

| Schuylkill Township | 0.25% | $900,000 | 2006 | |

| Upper Oxford Township | 0.50% | $171,000 | 2003 | |

| Warwick Township | 0.25% | $85,000 | 2003 | |

| Westtown Township | 1.08% EIT; $3.92 per $1,000 Real Estate Tax | $681,000 | 2022 | |

| West Bradford Township | 0.25% | $1,100,000 | 2017 | |

| West Brandywine Township | 0.125% | $200,000 | 2003 | |

| West Pikeland Township | 0.25% | $550,000 | 2007 | |

| West Vincent Township | $0.05 | $145,000 | 2002 | |

| 0.25% | $185,000 | 2006 | ||

| West Whiteland Township | 0.25% | $400,000 | No referendum | |

| Willistown Township | 0.125% | $564,000 | 1999 | |

| Totals | $0 | $10,678,500 |

Delaware County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Delaware County | $10,000,000 | Yearly budget allocation: No referendum | Bond: Approved by County Council in 2018 | |

| Chadds Ford Township | $0.0028 | $125,000 | 2005 | |

| Concord Township | $0.189 | $300,000 | 2004 | |

| $6,000,000 | 2004 | |||

| Middletown Township | $8,000,000 | 2019 | ||

| Radnor Township | .25% | $750,000 | 1994 | |

| $20,000,000 | 2006 | |||

| Upper Providence Township | $6,000,000 | 2003 | ||

| Totals | $44,000,000 | $1,175,000 |

Montgomery County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Montgomery County | Yearly budget allocation: No referendum | |||

| Franconia Township | 0.25% | $425,000 | 2001 | |

| Lower Frederick Township | 0.05% | $80,000 | 2020 | |

| New Hanover Township | 0.15% | $150,000 | 2006 | |

| Perkiomen Township | 0.125% | $250,000 | 2004 | |

| Skippack Township | 0.25% | $448,000 | 2001 | |

| Upper Dublin Township | $30,000,000 | 2008 | ||

| Upper Merion Township | $5,000,000 | 2006 | ||

| $0.00095 | $320,000 | 2005 | ||

| Upper Pottsgrove Township | 0.25% | $136,000 | 2006 | |

| Whitemarsh Township | 0.25% | $1,000,000 | 2006 | |

| Totals | $35,000,000 | $2,809,000 |

Philadelphia County

| Local Government | Bond | Current Tax Rate | Estimated Annual Tax Revenue | Year Approved |

| Philadelphia County | Not known (part of $134 million bond for multiple uses) | 2020 | ||

| Totals | Not known | $0 |

Failed Open Space Referendums (1988-2019)

1988 - 1995:

No known failed referendums

1996:

Hilltown Township (Bucks) - Issue an open space bond

Delaware County - Issue an open space bond not to exceed $100 million

1997:

Newtown Township (Bucks) - Establish 0.10% EIT dedicated to open space

1998:

Delran Township (Burlington) - Establish $.04 property tax dedicated to open space

Hamilton Township (Mercer) - Establish $.05 property tax dedicated to open space

North Hanover Township (Burlington) - Establish $.02 property tax dedicated to open space

1999:

Plumstead Township (Bucks) - Establish .5% EIT dedicated to open space

West Vincent Township (Chester) - Establish $.06 property tax dedicated to open space

2000:

Springfield Township (Bucks) - Issue an open space bond

2001:

Hamilton Township (Mercer) - Establish $.01 property tax dedicated to open space

2002:

Delanco Township (Burlington) - Establish $.025 property tax dedicated to open space

East Greenwich Township (Gloucester) - Increase existing property tax to $.04 dedicated to open space

2003:

East Nottingham Township (Chester) - Establish 0.50% EIT dedicated to open space

Hopewell Township (Mercer) - Increase existing property tax to $.04 dedicated to open space

London Grove Township (Chester) - Establish 0.25% EIT dedicated to open space

2004:

Deptford Township (Gloucester) - Establish $.02 property tax dedicated to open space,

Franklin Township (Gloucester) - Increase existing property tax to $.02 dedicated to open space

Hopewell Township (Mercer) - Increase existing property tax to $.04 dedicated to open space

Northampton Township (Bucks) - Establish 0.15% EIT dedicated to open space

2005:

Lumberton (Burlington) - Continue $.03 property tax dedicated to open space for an additional 3 years (tax reverts to already established $.01 property tax)

Schuylkill Township (Chester) - Issue an open space bond not to exceed $20 million

Wallace Township (Chester) - Establish 0.25% EIT dedicated to open space

2006:

Berlin Borough (Camden) - Establish $.02 property tax dedicated to open space

2007:

Hopewell Township (Mercer) - Increase existing property tax to $.05 dedicated to open space

Washington Township (Gloucester) - Increase existing property tax to $.04 dedicated to open space

2008:

Harrison Township (Gloucester) - Increase property tax by $.04 tax per $100 assessed property value

Hatfield Township (Montgomery) - Establish .125% EIT dedicated to open space

Mantua Township (Gloucester) - Increase property tax by $.02 tax per $100 assessed property value

2009:

Mantua Township (Gloucester) - Increase property tax by $.02 tax per $100 assessed property value

2013:

Borough of Merchantville (Camden) - Establish $.02 property tax dedicated to open space

2016:

Lower Moreland Township (Montgomery) – Establish .25% EIT for open space

2022:

Limerick Township (Montgomery) – 0.25% EIT increase

Edgewater Park Township (Burlington) – Increase property tax by $.02 per $100 assessed property value

Robbinsville Township (Mercer) – Increase property tax by $.02 tax per $100 assessed property value

Exhausted Open space bond referendums (Starting in 1987)

(Many of these bonds were designated for specific tracts of land)

- Bucks County - $87 million, approved 2007

- Upper Dublin Township (Montgomery) - $30 million, approved 2006

- Middletown Township (Delaware) - $8.5 million, approved 2005

- Solebury Township (Bucks) - $18 million, approved 2005

- Plumstead Township (Bucks) - $10 million, approved 2005

- Upper Providence Township (Delaware) - $6 million, approved 2003

- Warwich Township (Bucks) - $5 million, approved 2003

- Bedminster Township (Bucks) - $2.5 million, approved 2002

- Solebury Township (Bucks) - $12 million, approved 2002

- Wrightstown Township (Bucks) - $1.5 million, approved 2002

- Radnor Township (Delaware) - $2.5 million, approved 2002

- Plumstead Township (Bucks) - $6 million, approved 2001

- Upper Makefield Township (Bucks) - $15 million, approved 2000

- Mansfield Township (Burlington) - $1 million, approved 2000

- Charlestown Township (Chester) - $2.1 million, approved 2000

- Warwick Township (Bucks) - $1.5 million, approved 2000

- Chester County - $75 million, approved 1999

- Solebury Township (Bucks) - $10 million approved 1999

- Buckingham Township (Bucks) - $9.5 million, approved 1999

- Whitpain Township (Montgomery) - $14 million, approved 1999

- Voorhees Township (Camden) - $10 million, approved 1998

- Lower Makefield Township (Bucks) - $7.5 million, approved 1998

- Middletown Township (Bucks) - $325,000, approved 1998

- Newtown Township (Bucks) - $2.75 million, approved 1998

- Northampton Township (Bucks) - $5 million, approved 1997

- Bedminster Township (Bucks) - $2.5 million, approved 1997

- Upper Makefield Township (Bucks) - $6 million, approved 1996

- East Goshen Township (Chester) - $3 million, approved 1996

- Radnor Township (Delaware) - $7.5 million, approved 1996

- Tredyffrin Township (Chester) - $8 million, approved 1996

- Nether Providence Township (Delaware) - $2.8 million, approved 1996

- New Britain Township (Bucks) - $2.5 million, approved 1996

- Solebury Township (Bucks) - $4 million, approved 1996

- Plumstead Township (Bucks) - $4 million, approved 1996

- Buckingham Township (Bucks) - $4 million, approved 1995

- Warrington Township (Bucks) - $2.1 million, approved 1995

- Warwick Township (Bucks) - $1.5 million, approved 1995

- Wrightstown Township (Bucks) - $1.5 million, approved 1995

- Radnor Township (Delaware) - $10 million, approved 1994

- Bucks County - $3.5 million, approved 1994

- Lower Providence Township (Montgomery) - $3.1 million, approved 1994

- West Goshen Township (Chester) - $3 million, approved 1994

- Lower Gwynned Township (Montgomery) - $2 million, approved 1994

- Lower Merion Township (Montgomery) - $1.9 million, approved 1994

- Montgomery County - $100 million approved in 1993 (full amount was not bonded)

- Doylestown Township (Bucks) - $3.75 million, approved 1991

- Chester County - $50 million, approved 1989

- Middletown Township (Delaware) - $5.4 million, approved 1987

Sources

New Jersey:

Steve Jandoli and the New Jersey Green Acres Program; Frederick Douthitt and the New Jersey State Agriculture Development Committee; Division of Local Government Services, New Jersey Department of Community Affairs; Andrew du Moulin and the Trust for Public Land, LandVote®; The Courier-Post; The Gloucester County Times; The Philadelphia Inquirer; Burlington County Department of Resource Conservation; Camden County Division of Open Space and Farmland Preservation; Gloucester County Planning Department; Mercer County Planning Division; and New Jersey municipalities.

Pennsylvania:

Mike Frank, Sean Sullivan and the Heritage Conservancy; Andrew du Moulin and the Trust for Public Land, LandVote®; The Philadelphia Inquirer; Bucks County Planning Commission; Chester County Planning Commission; Delaware County Planning Department; Montgomery County Planning Commission; Pennsylvania Department of Community and Economic Development; and Pennsylvania municipalities.